Can You Afford to Ditch This Easy, Cheap Vacation Safeguard?

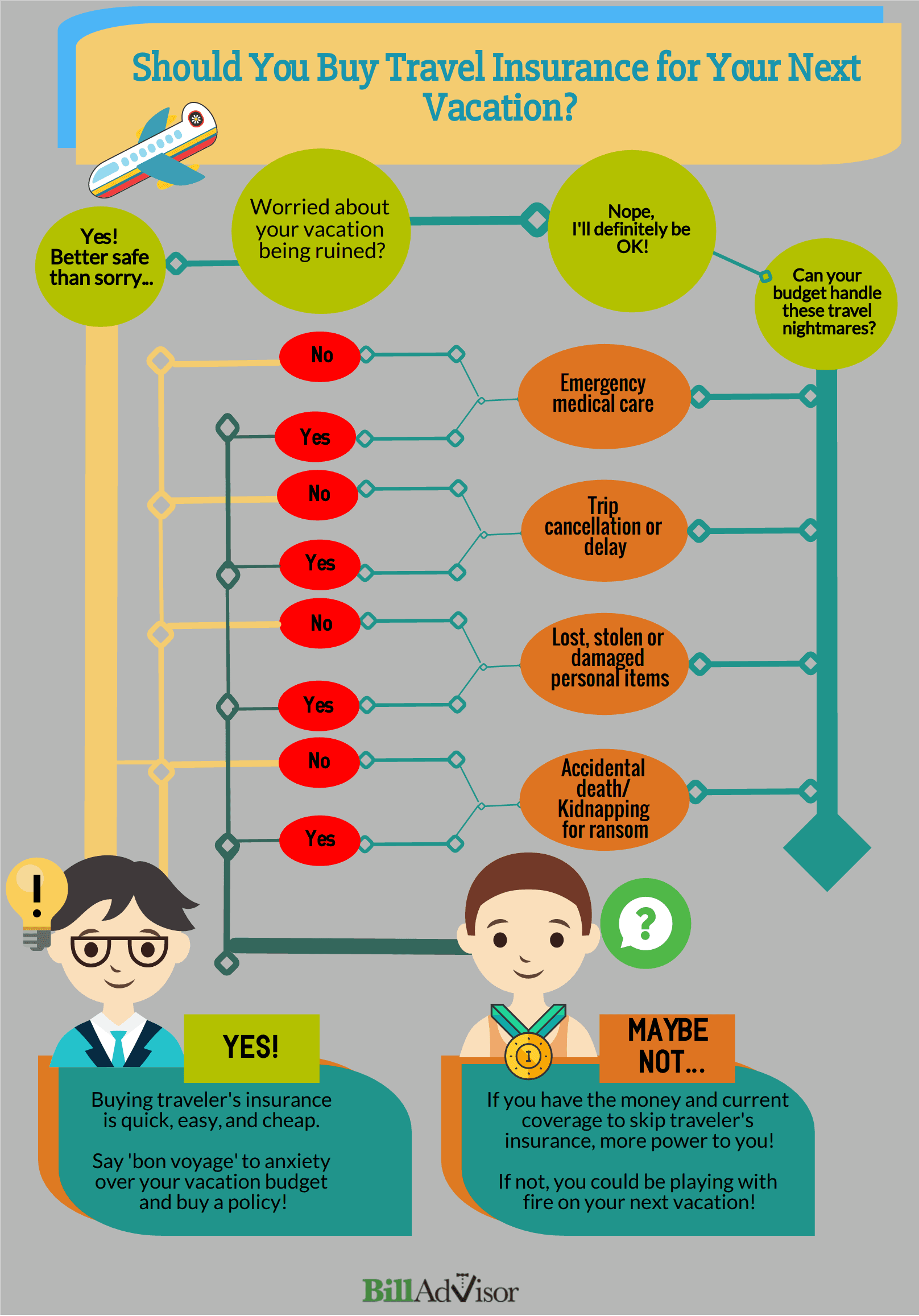

Is travel insurance an unnecessary expense, or a simple and inexpensive way to avoid unexpectedly blowing your budget?

If you’re planning on taking a vacation, the last thing you want is to deal with is an unforeseen event. Wanting to be safe rather than sorry may have you wondering if you should buy travel insurance in case of a disruption.

That sounds like an excellent idea – but how do you know if your next journey truly warrants insurance?

We’ll help you determine whether travel insurance is right for your trip by covering how it works to protect you, plus how to know whether you should buy a policy based on your situation.

How Travel Insurance Works

Your vacation itinerary is planned, your bags are packed, and you’re ready to start shopping for travel insurance… So how will it help if any part of your plans fail?

There are several types of travel insurance policies designed to protect your financial investment (including before and during a trip). The most basic plans typically include coverage for:

- Trip cancellations, interruptions, and delays.

- Personal belongings coverage.

- Emergency medical care.

- Accidental death.

- 24/7 Traveler Assistance

What It Covers:

After your purchase, travel insurance kicks in to reimburse or cover only out-of-pocket expenses for unexpected events as outlined in your policy details.

What It Does Not Cover:

Travel insurers won’t protect anything listed in your policy as an exclusion. They also don’t cover important preparations which you’re personally responsible for but did not properly manage or complete (like missing a connecting flight, for example).

Is traveler’s insurance expensive?

Luckily, many deals are sold in packages. This means you can get the best all-in-one value if you want to safeguard against different types of threats.

Actual quotes vary based on what you’re trying to insure. For instance, a flight, personal items like luggage, medical care – but travel insurance is generally very inexpensive.

“Insuring $1,000 worth of personal belongings for a week could cost about $50 per year”. – Insurance Information Institute

Niche travel insurance policies are also available for students and senior citizens, who may require more specialized coverage and tend to have more restricted incomes. So you don’t have to worry about ruining your budget!

The Best Type of Travel Insurance for You

So, if you’re convinced you need to protect your next trip (and wallet) against sudden and expensive events, what kind of insurance do you need in the first place?

While we don’t recommend travel insurance coverage for a quick, low-budget or domestic trip, buying the right policy is crucial for more specific vulnerabilities like:

- Families and/or pregnant women

- Frequent travelers

- Vacations with potentially risky physical activity (rock-climbing, skiing, etc.)

- Individuals with a history of medical problems

- Destinations with a history of natural disasters

- Expensive, or lengthier getaways (like cruises or resort stays)

- *Locales with a higher incidence of disease, political instability, and/or crime.

Wrapping Up

If you fall into any of the categories above – or if you just don’t feel comfortable leaving your vacation investment in the hands of Fate – it’s definitely a good idea to consider buying travel insurance.

Now that you know whether or not you should bother getting travel insurance, you’ll be ready to make your next move.

Questions or suggestions on how to find the right travel insurance? Let us know in the comments!

Which Unique Tax Credits Define You?

Which Unique Tax Credits Define You? How to Keep Your Money Safe When on Vacation

How to Keep Your Money Safe When on Vacation Road Trips: 7 Amazing Facts You Never Knew

Road Trips: 7 Amazing Facts You Never Knew